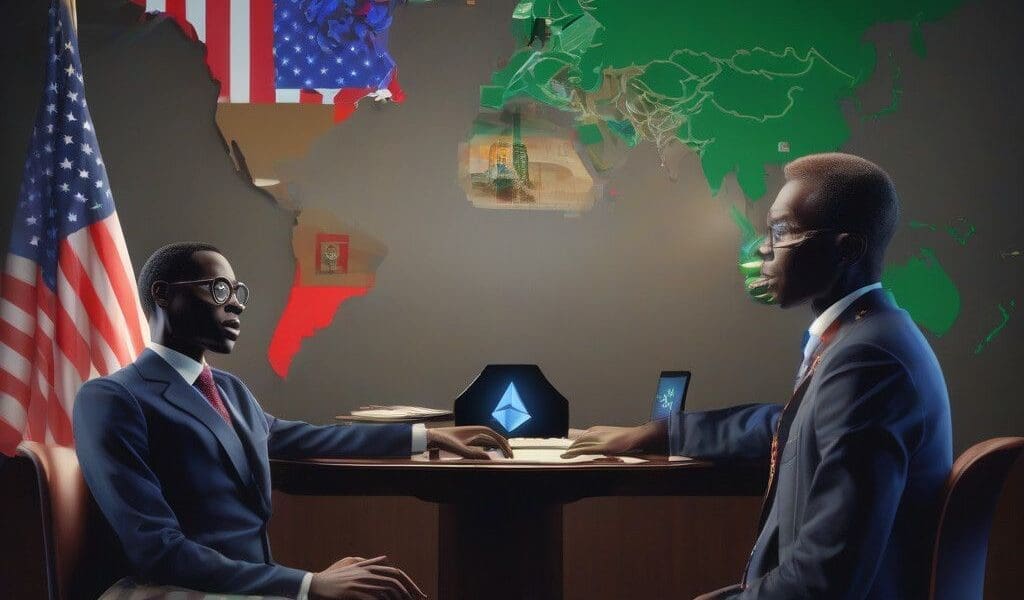

US and Nigeria Strengthen Ties to Combat Crypto Misuse

The rise of digital finance has significantly altered the landscape of global commerce, offering both opportunities and challenges. One of the most pressing challenges is the misuse of cryptocurrencies and digital assets for illicit activities, particularly in cybercrime. In response to this concerning trend, the United States and Nigeria have joined forces by launching the Bilateral Liaison Group on Illicit Finance and Cryptocurrencies. This strategic initiative seeks to enhance both nations’ capabilities in investigating and prosecuting financial crimes related to digital finance.

The need for such collaboration has been underscored by recent events, namely the detention of Tigran Gambaryan, Binance’s head of financial crime compliance, who faced money laundering charges in Nigeria. His release due to health concerns has raised tensions, highlighting the importance of improved relations. By forming this liaison group, both countries are not only addressing immediate concerns but also establishing a framework for ongoing cooperation in cybersecurity and financial enforcement.

Objectives of the Bilateral Liaison Group

At its core, the Bilateral Liaison Group aims to bolster cross-border coordination between the US and Nigerian enforcement agencies. This partnership reflects a shared commitment to tackling the complexities of financial crimes associated with the ongoing expansion of digital finance. The group’s objectives include:

1. Enhanced Investigative Support: The collaboration will facilitate sharing of intelligence and resources, enabling quicker and more effective investigations into financial crimes involving digital currencies.

2. Strengthened Prosecutions: There will be a focus on developing shared legal frameworks that can ease the prosecution of offenders across borders. This addresses the challenges faced when criminals operate in multiple jurisdictions.

3. Capacity Building: Both countries plan to invest in training and resources to improve their respective enforcement agencies’ understanding and capabilities in handling cases of crypto-related financial crime.

The Importance of Cross-Border Cooperation

The fight against financial crime in the digital age inherently requires international collaboration. Cryptocurrencies operate on decentralized networks, allowing individuals to transfer value globally without any central authority tracking these transactions. This very nature makes it challenging for any one country to effectively combat misuse alone.

For example, in 2020, the US Department of Justice highlighted a case where individuals laundered over $25 million in cryptocurrency through complex schemes that exploited several jurisdictions. The international cooperation between law enforcement agencies in this particular case was pivotal in apprehending the suspects and dismantling the operation. The establishment of the Bilateral Liaison Group reflects an understanding that similar cooperation is essential to curb the growing threat of digital currency-related crime.

Looking Ahead

As digital currencies become increasingly integral to the financial system, it is crucial for governments to adapt their regulatory frameworks and enforcement strategies. The US and Nigeria are taking a proactive step by creating this liaison group, aiming to address vulnerabilities before they are exploited by criminals.

Furthermore, the collaboration could serve as a model for other nations grappling with similar challenges. By showcasing the potential effectiveness of joint efforts in combating cybercrime, this initiative may inspire expanded partnerships that strengthen global cybersecurity frameworks.

In conclusion, the joint effort between the US and Nigeria through the Bilateral Liaison Group on Illicit Finance and Cryptocurrencies is a significant development in the fight against financial crime. As both nations work together to navigate the complexities of the digital finance landscape, their combined efforts have the potential to create a safer, more secure environment for digital transactions.