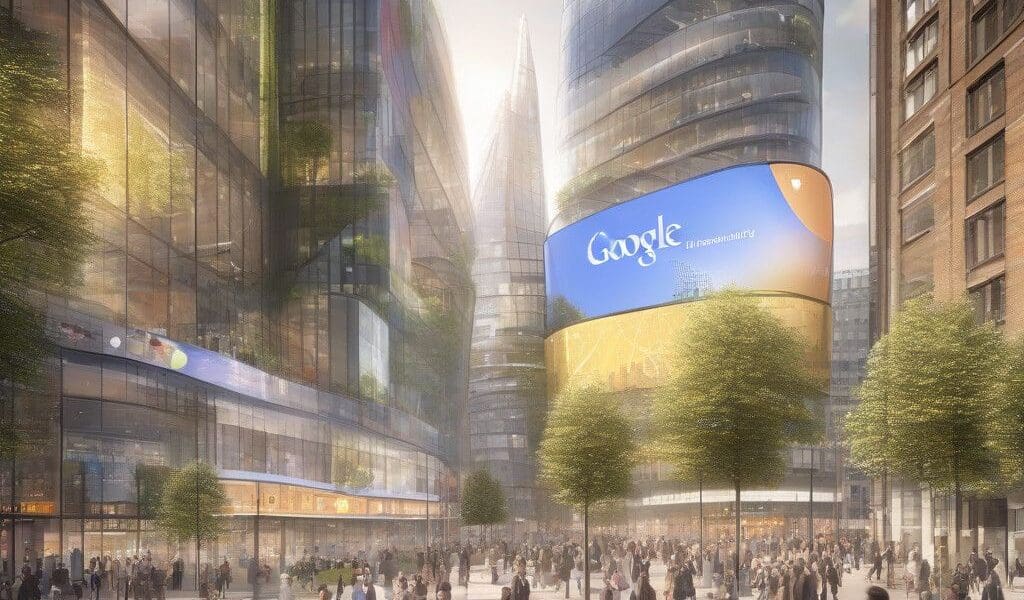

Google's Role in the Transformation of the UK Bond Markets

The financial landscape is constantly shifting, driven by technology and the demand for transparency. A prominent shift is underway in the UK bond market, with several influential players, including Google, Norway’s sovereign wealth fund, and UBS, forming a coalition to support the creation of a real-time bond tape system. This initiative aims to streamline bond transactions by consolidating market data, enhancing transparency and accessibility for investors.

Understanding the Bond Market

Traditionally, the bond trading market has been characterized by its fragmented nature and lack of price transparency. Transactions often occur bilaterally, leaving a gap in clear, accessible data that investors need to make informed decisions. The proposed bond tape system seeks to solve these issues by providing a real-time data feed that will offer critical insights into bond pricing and trading activities, similar to systems successfully employed on Wall Street.

The Coalition’s Goals

Ediphy, a London-based technology firm specializing in fixed-income markets, spearheads this initiative. Collaborating with established partners like Cboe Global Markets, FactSet, and TP ICAP, Ediphy aims to develop a comprehensive system that ensures transparency and fairness in bond trading. Google Cloud, with its extensive data storage capabilities, is expected to play a significant role, potentially housing vast amounts of market data critical for the operation of this new system.

The primary objective is to increase transparency in the bond market, providing investors with a comprehensive view of ongoing transactions and pricing details. This enhanced visibility is anticipated to lead to better decision-making and ultimately a more efficient market that benefits all participants.

Regulatory Perspectives

The UK’s Financial Conduct Authority (FCA) recognizes the need for such a system and plans to initiate the tendering process to select an operator for the bond tape by the end of 2024. This move signifies a robust commitment to transforming how bond information is shared and accessed, with the goal of having the system operational by 2026.

The integration of a real-time bond tape system will not only enhance market liquidity but is expected to improve overall market efficiency. Investors will be better equipped to gauge market movements and make more informed choices on bond investments, significantly benefiting from the productivity gained through increased information availability.

Challenges from Market Participants

While many in the financial community support the bond tape initiative, concerns have been raised, particularly from exchanges. Some exchanges fear that implementing such a system could disrupt their existing data streams, which are often lucrative revenue sources. Ediphy’s CEO, Chris Murphy, has emphasized the importance of creating a system that balances competing interests while being both affordable and effective.

The reluctance of exchanges highlights a crucial aspect of market reform — the need to integrate new solutions without alienating established players within the financial ecosystem. Pressuring existing profit models can lead to resistance, so it is essential to navigate these waters carefully.

A Step Towards Modernization

Incorporating a real-time bond tape system represents a significant leap forward for the UK capital markets. By harnessing modern technology and collaborative efforts from major industry players, the UK aims to close the gap in bond market transparency. The synergy between technology companies and financial institutions can propel the sector toward a more transparent and efficient trading environment.

Historically, similar initiatives in other regions, particularly the U.S., have proven the effectiveness of real-time data sharing in capital markets. They have led to a marked increase in trading efficiency and reduced the information asymmetries that previously affected market fairness and pricing.

As the UK’s initiative progresses, it offers an exciting opportunity to reshape the bond market landscape. With enhanced transparency, investors will likely experience a more competitive environment leading to better pricing and trading opportunities. The outcome will not only benefit large institutional investors but also empower smaller players in the market, ultimately contributing to a more diversified capital market.

In conclusion, as Google and its partners prepare to spearhead this transformative project, all eyes will be on the implementation of this critical system. Success will depend on the collaboration between technology and finance sectors and the careful management of existing market dynamics. The anticipated bond tape system could serve as a model for other markets, paving the way for a new era of transparency and efficiency in the financial landscape.