Russian Official Advocates for Domestic Stablecoin Alternatives Amid USDT Wallet Freeze

In light of the recent freeze on USDT wallets, the Russian government is taking proactive steps to explore the development of domestic stablecoins as alternatives. This move comes as a response to the growing concerns over the country’s reliance on foreign-issued tokens and the potential risks associated with such dependencies.

The freeze on USDT wallets, a popular stablecoin pegged to the US dollar, has sent shockwaves through the global cryptocurrency market. With USDT being one of the most widely used stablecoins in the world, the sudden halt in transactions has underscored the vulnerabilities of relying on a single foreign-issued digital asset.

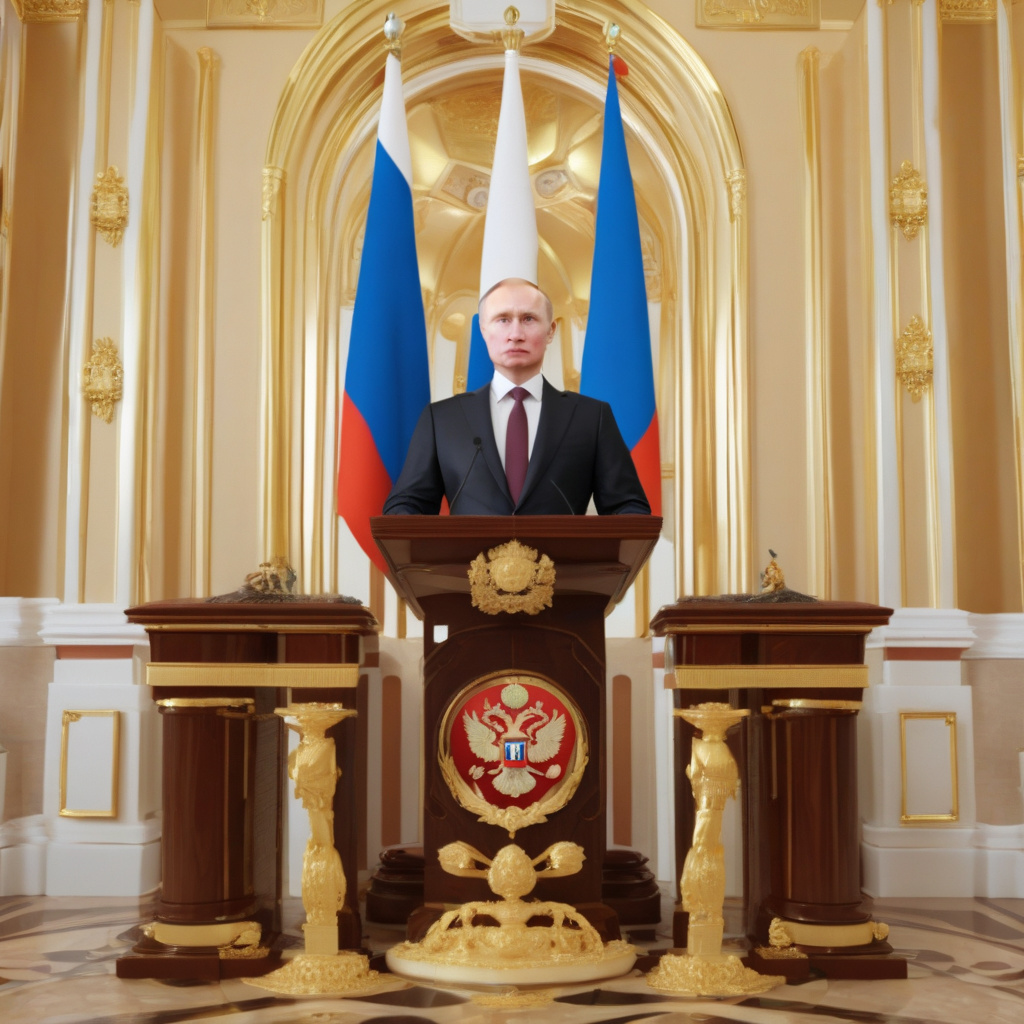

In response to this development, a high-ranking Russian official has called for the creation of domestic stablecoin alternatives to USDT. By developing stablecoins that are backed by Russian assets and controlled within the country’s borders, the government aims to reduce its exposure to external risks and ensure greater stability in its digital currency ecosystem.

The push for domestic stablecoins is part of a broader trend towards digital sovereignty and financial independence. Countries around the world are increasingly looking for ways to assert greater control over their monetary systems in the face of ongoing geopolitical uncertainties and regulatory challenges.

For Russia, the development of domestic stablecoins represents an opportunity to strengthen its financial resilience and protect against external disruptions. By creating digital assets that are tied to the country’s own currency and economic resources, Russian officials believe they can insulate their economy from the volatility and uncertainties of the global market.

Moreover, domestic stablecoins could also help boost financial inclusion and foster innovation within the Russian digital economy. By providing a secure and reliable means of transacting in digital currencies, these new assets could open up new opportunities for businesses and consumers alike, driving growth and development in the sector.

While the road to implementing domestic stablecoins may present challenges, including regulatory hurdles and technological complexities, the potential benefits for Russia’s financial ecosystem are significant. By reducing reliance on foreign-issued tokens like USDT, the country can take greater control over its monetary policy and insulate its economy from external shocks.

As other countries grapple with similar concerns over the dominance of foreign stablecoins, the Russian government’s initiative to explore domestic alternatives could serve as a model for digital financial sovereignty. By prioritizing the development of homegrown digital assets, countries can enhance their economic security and pave the way for a more stable and resilient financial future.

In conclusion, the call for domestic stablecoin alternatives in Russia reflects a growing recognition of the need for digital financial independence in an increasingly interconnected world. By taking proactive steps to develop homegrown digital assets, the country aims to reduce its reliance on foreign-issued tokens and strengthen its financial resilience in the face of global uncertainties.

#Russia #Stablecoins #USDT #DigitalCurrency #FinancialIndependence