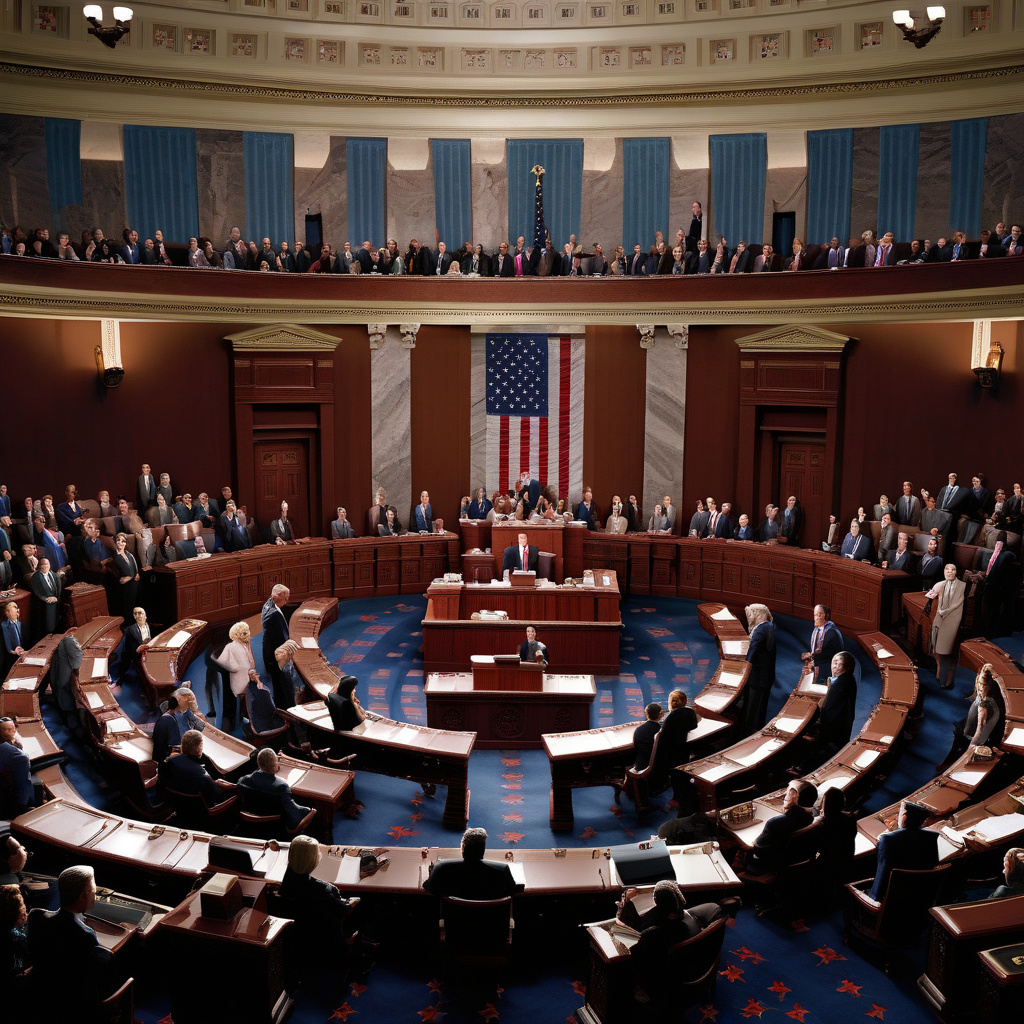

Senate Passes Trump Bill Without Crypto Tax Breaks

The recent decision by the Senate to pass the Trump bill without including tax breaks for cryptocurrencies has sent ripples through the digital asset community. One of the proposed changes in the bill was to tax staking rewards only upon sale, a move that many in the crypto space viewed as a step in the right direction towards more favorable taxation policies. Additionally, the bill aimed to introduce exemptions for small crypto transactions, which would have eased the tax burden on retail investors and everyday users of digital currencies.

The exclusion of these provisions from the final bill highlights the ongoing challenges faced by the cryptocurrency industry in gaining mainstream acceptance and regulatory clarity. Without clear guidelines on taxation and reporting requirements, investors and users are left in a state of uncertainty, unsure of how to navigate the complex landscape of crypto taxation.

Proponents of the tax breaks argue that they are essential for fostering innovation and growth within the crypto sector. By incentivizing participation through favorable tax treatment, the industry could see increased adoption and investment, leading to further development of blockchain technology and decentralized finance solutions.

Opponents, on the other hand, raise concerns about the potential loss of tax revenue and the risk of tax evasion in an already volatile and speculative market. They argue that imposing stricter tax regulations is necessary to ensure compliance and prevent illicit activities such as money laundering and fraud.

The absence of crypto tax breaks in the Senate-passed bill underscores the need for a more nuanced and comprehensive approach to regulating cryptocurrencies. Rather than imposing blanket taxation policies that may stifle innovation, policymakers should work towards creating a regulatory framework that balances the needs of investors, users, and the government.

Countries like Switzerland, Singapore, and Malta have emerged as crypto-friendly jurisdictions by implementing clear and progressive regulatory frameworks that support the growth of the digital asset economy. By studying and adapting these models to suit their own unique circumstances, countries like the United States can position themselves as leaders in the global crypto market.

In conclusion, the Senate’s decision to pass the Trump bill without including tax breaks for cryptocurrencies reflects the ongoing debate surrounding the regulation and taxation of digital assets. As the industry continues to evolve, it is crucial for policymakers to strike a balance between fostering innovation and protecting the interests of all stakeholders. Only through a collaborative and forward-thinking approach can the full potential of cryptocurrencies be realized.

#Senate, #Trump, #CryptoTax, #Regulation, #DigitalAssets